How does a Medicare Advantage HMO work?

✅ To Find Out Which Medicare Advantage Plan Is Best For You Fill Out The Form 👉

Table of contents

Just one of many questions people have as they approach retirement age. As if Medicare wasn’t complicated enough already. Now we have to had the additional variable of networks.

Luckily for you, it’s not nearly as complicated as it seems. So to explain how an Medicare Advantage HMO works, we’ll first learn a little about HMO’s and Medicare alone. Then understanding how they work together will be much simpler.

Most people are familiar with the letters HMO or PPO

as “Something to do with health insurance?…”, but few actually know what those letters mean and how the different plans work.

Like most insurance products, they have a lot of moving parts that can seem very complicated. To make matters worse, Medicare Members are overwhelmed with ads all telling them “XYZ plan is THE BEST”.

As we always say, the best plan is the plan that’s best for YOU. And it’s kinda hard to know which plan is best for you, if you don’t even know how they work.

I think this is long overdue…

but here it is.

The no nonsense simplified guide to HMO health plans.

Fair Warning

This guide may have all your friends coming to you with questions about:

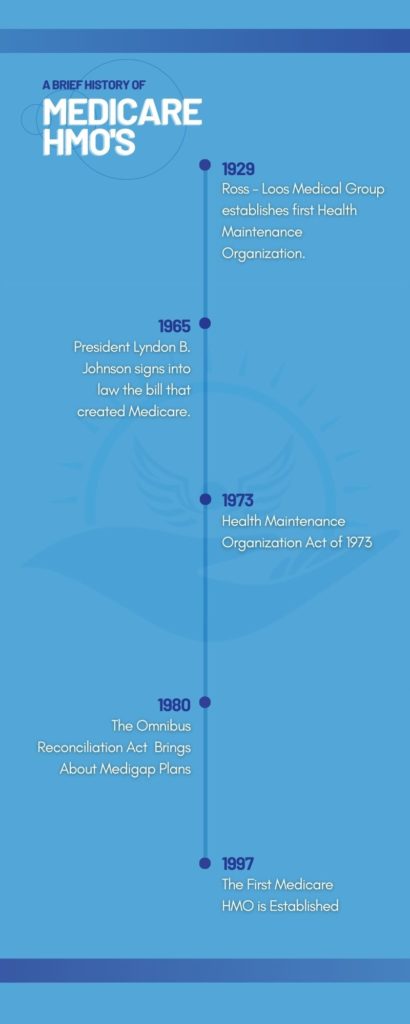

- The History of HMO’s

- When HMO’s were first introduced to healthcare, and what they aimed to achieve. How they’ve evolved over the years to adjust with the U.S. Healthcare system.

- HMO’s and Medicare

- When HMO’s were integrated into the Medicare system. How those Medicare HMO’s differed from the current day plans, and how the Medicare and the HMO networks work together.

- How HMO’s work

- The most important things to know when considering an HMO. How they differ from other healthcare networks, and the pros and cons of HMO’s compared to other plans.

- Who HMO’s are good for

- The type of person best served by an HMO. Who should be very careful in their HMO selection, and Who should likely look at other health plans

In The Beginning

Pre 1900 health insurance didn’t really exist like it does today. There were small insurance pools that would provide Indemnity policies. It wasn’t until 1910 that Anything resembling an HMO would exist in America.

It wasn’t until 1929 that the first recognized HMO was built. This plan was only offered to those employed by certain departments of the city of Los Angeles.

When the “Health Maintenance Organization Act of 1973” was passed, grants and loans were given to develop Federally Qualified HMO’s.

The government wanted to make this type of insurance more accessible to the public. In order to be federally qualified, the plans had to:

- Cost the same as or less than traditional insurance plans

- Offer more comprehensive benefits packages

- Be available to more than just the insurance carriers “Ideal Client” as HMO’s had been previously

The idea behind Coordinated Care was to keep members healthy. This would then take some of the burden of claims off of the insurance carriers.

Turns out, when people have smaller copays, they actually go to the doctor more. To this day, the HMO doesn’t save the insurance company any more money than a PPO does.

But they sure save the beneficiaries a lot of money, and that’s really who we’re rooting for here!

A Match Made In Heaven: The Medicare Advantage HMO

In 1997 “Medicare HMO’s” known now as “Medicare Advantage” or “Part C” were signed into law.

This was huge!

Prior to this the only way to put a cap on the out of pocket costs of Original Medicare was to pay additional premiums for a Medicare Supplement plan.

Now Medicare Beneficiaries had three choices: Original Medicare only, Medicare + a supplement, or a Medicare Advantage HMO.

So How Does Medicare work with an HMO?

HMO stands for Health Maintenance Organization. From the beginning HMO’s were designed with the goal of keeping members healthier longer.

That’s where the Care Coordination comes in.

In an HMO, your Primary Care Provider (PCP) is considered your Care Coordinator. Another phrase people use is gatekeeper because some people hate needing to get referrals for specialists.

No ones trying to limit your options. HMO’s use a network of Doctors, Hospitals, and Healthcare Professionals to manage your health for you.

Insurance carriers want nothing more than for you to stay healthy. They designed HMO’s to save them money through preventative care to reduce their members chance of hospitalization.

In the end, the low copays that drew so many members to their plans, would actually make people go to the doctor more often.

But they haven’t given up. HMO plans continue to improve, year after year, as the carriers try to keep members healthier. The carriers also have to add more and more benefits to stay competitive in their markets.

In short…

When insurance carriers fight for your business. You. Win.

Is a Medicare Advantage HMO Right For Me?

That depends on…

- What’s available in your area

- Do all your doctors take all of those plans?

- Which of those plans cover all your prescriptions

- What plans have Dental that covers the specific procedure you need

- Etc.

The truth is, in many cases it doesn’t come down to choosing an HMO, HMO-POS, PPO, or Regional PPO.

If done right, you and your agent should know approximately how much each plan will cost you out of pocket for the next year.

All else equal, that’s all you’d really care about.

BUT if you are someone that travels a lot, or lives in different states throughout the year, then you’re most likely better off with the broader network of a PPO.

That’s not to say it can’t be done with an HMO. There are carriers that use reciprocal HMO networks that extend into other states. You just need to be sure you know

HMO’s have the strongest benefits packages, the lowest copays, the lowest Max Out Of Pockets, and lowest (most time zero) prescription drug deductible.

HMO’s coordinated care practice can be seen as restrictive, and in the case of snow birds I would have to agree. But generally speaking, people in decently populated areas who live in the same place all year should give some serious thought to an HMO plan.

Conclusion

Our step-by-step process to find the best medicare solution for you is exactly the kind of care we give to every one of our clients. Fill out the form on the right side of this page and schedule some time with one of us to ask all of those important questions. Once we have only a handful of options left that are going to cover YOUR needs, then we can have the “is an HMO right for me?” talk and choose the plan that’s best for you!