How To Apply For Medicare

As you get older, it’s important to know how Medicare works. It can be confusing and difficult to figure out which plan is best for you. This blog post will help break down the process of applying for Medicare so that it is easier to understand.

Factors such as income level, health insurance coverage, and medical needs must all be considered before deciding on a plan that is right for your retirement years. After reading this blog post, I hope that you have a better understanding of how to apply for Medicare!

Article Navigation

- Gather the Necessary Information to Apply for Medicare

- Best Time To Apply For Medicare

- Complete and Submit Your Application Online

- How to Apply for Medicare by Phone

- Going To Your Local Social Security Office and Applying In Person

- How Does Medicare Work With Employer Insurance

- Wait for a Response From Medicare About Eligibility

- Conclusion

Gather the Necessary Information to Apply for Medicare

Applying for Medicare can be an intimidating experience, but it’s much easier than you might think. We have helped thousands of people sign up over the years so don’t worry if this is your first time applying!

In order to help make things as easy on yourself as possible we’ve broken down what you need to know and how long each step takes before signing up below:

- -Informational video from Social Security Administration (1 minute)

- -Apply online through MyMedicare or call 1-800 MY SOCIAL SECURITY (3 minutes)

- -Confirm address changes with SSA when prompted by email notification(2 minutes)

The Social Security office is where you can get your Medicare application taken care of. They offer many options for applying, so whether you have time before the deadline or need to apply ASAP they’ve got a solution that fits any schedule. If aging into Medicare in 3 months, just head on over and start filling out their forms now!

You don’t want to take too long because it might be hard finding someone who will give up some spare time if places are already full when we do our final check-in at 65 years old (and yes there’s plenty of benefits waiting!)

This is your time to make a decision about whether or not you want Medicare. The only way for everyone eligible to enroll in it, however, will be during this period of time so don’t miss out!

Best Time To Apply For Medicare

Medicare can be confusing to grasp, especially if you’re not even sure what social security is. Medicare provides health insurance for people over 65 and those with disabilities regardless of whether they are on Social Security or Railroad Retirement Board benefits.

It also covers dependents under age 18 who have been disabled since before the child turned 22 years old as well as any spouse that has a disability from which he/she will never recover.

Medicare coverage starts at age 65 but it doesn’t automatically notify its members when enrollment begins like many other places do nowadays because there’s no need!

If you’re already receiving income-related retirement benefits such as Social Security or Railroad Retirement Board payments then your card should arrive 1-2 months in advance.

If you are not yet taking retirement benefits, then it is your responsibility to sign up for Medicare. The government expects that when our time comes we will know how and where to enroll in this program.

Let’s look at the timeline of events from registering with a Social Security card or number until receiving an ID card!

What Is The Initial Enrollment Period

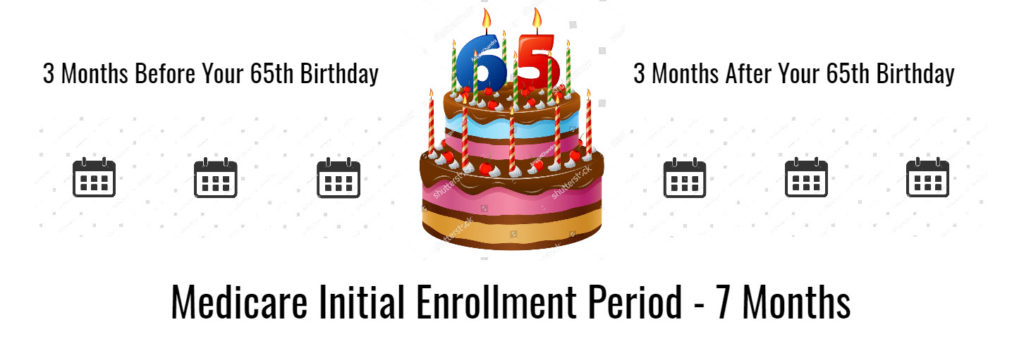

Your Initial Enrollment Period (IEP) for Medicare Parts A, B, and D lasts 7 months. You will have no late penalties when you enroll during your IEP which begins 3 months before your 65th birthday month and runs for 3 more after it ends.

There are also no pre-existing condition waiting periods so if you need to make any changes or start a new medication there is plenty of time without penalty!

Registering for Medicare is a huge decision, so it’s important to know the deadlines! If you’re still working and have employer coverage, your enrollment period begins during the open season.

This may not be right for everyone though – in some cases retirees who are getting their health benefits from an ex-spouse or former spouse might want this time frame because they can’t enroll at any other time of year with that type of plan.

Be sure to speak with someone on our team about how best to handle these situations before registering yourself into something that doesn’t work well without talking first!

Complete and Submit Your Application Online

Many Medicare beneficiaries prefer to sign up for their coverage without having to leave home.

Social Security offers you a quick online application that can be completed in only ten minutes or less, so there’s no need for seniors and disabled persons on income assistance programs like SSI/SSDI to miss work just because they want more information about signing up with the program.

Just visit SSA website and follow the links about applying for Medicare!

- To apply for both SS retirement benefits and Medicare at the same time, visit this link: https://www.ssa.gov/retire

- To apply just for medicare, go here: https://www.ssa.gov/benefits/medicare/

While you wait to hear back from Social Security on your application request, our friendly agents can help you learn about what types of coverage are available with a supplement plan or as stand-alone insurance depending upon your needs!

Enrolling in Medicare online is the easiest way to do it, but occasionally people run into problems because some of their data isn’t accurate. If this happens, you can consider signing up by phone instead. Let’s take a look at how that works next!

How to Apply for Medicare by Phone

Perhaps the most daunting thing about applying for Medicare is knowing how to do it.

Luckily, while there are many ways to apply for social security benefits via phone or online, you can also call Social Security at 1-800-772-1213 (1-800-325 0778) and speak with a representative who will walk through all of your options in detail – which might be just as easy as choosing one!

Applying for Medicare is a fairly simple process, but there are some steps that you may not be aware of. One caveat about phone applications for Medicaid/Medicare is that they take longer.

The forms have to be mailed to your home address and then completed before being sent back in the mail which can cause delays with paperwork if it’s only two or three weeks until your intended effective date.

However, this option will work better if you’re able to plan ahead by at least four months because waiting on documents from SS takes time as well!

If possible try going into an office-based location instead where staff members would guide you through filling out any necessary information and provide help along the way.

Going To Your Local Social Security Office and Applying In Person

If you’re close to turning 65, then getting your Medicare application processed quickly might be a priority.

Luckily for those who prefer the in-person experience at local Social Security offices, there are many conveniently located all over the country and they can get your paperwork processed faster than mailing it in or filing online with Healthcare.gov (a government website).

How Does Medicare Work With Employer Insurance

Enrolling in Medicare before you turn 65 is a great way to make sure that your coverage starts on the first of your birthday month. If you’re applying for Medicare as your primary cover, be sure to enroll 3 months prior so it’ll start at the beginning of next year!

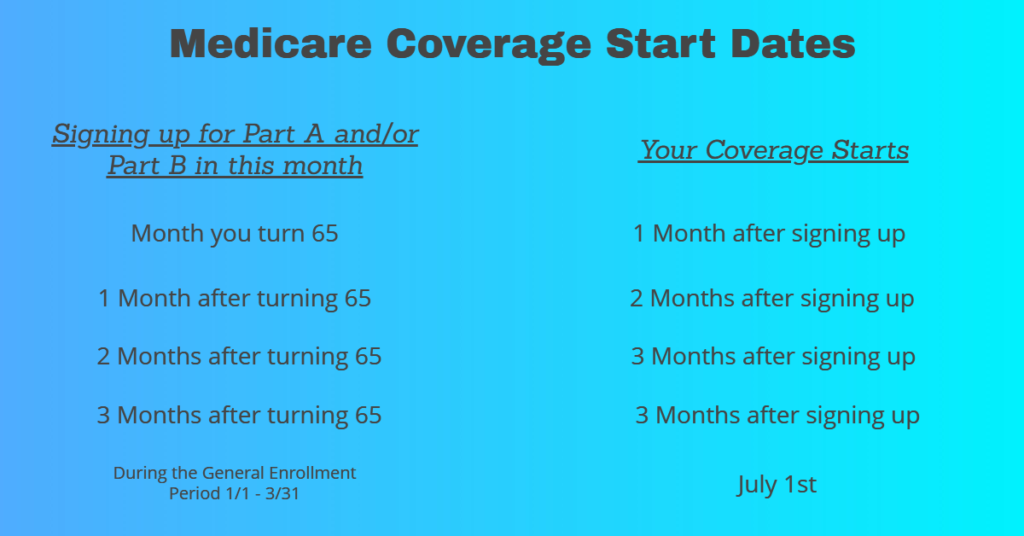

Registering for Medicare in the few months following your 65th birthday has its benefits, but it also comes with consequences. People who are unaware of this could end up with a gap in their health coverage that they didn’t expect!

It’s important to understand how registration date affects start dates because people can easily forget about these details while registering.

You may be taken aback when you learn that there are several enrollment periods, not just one. If you’re leaving your employer coverage in the middle of your Medicare Initial Enrollment Period (IEP), then this trumps any other election period and will result in a gap in medical care if an immediate replacement plan is not created.

We’ve seen people assume their Medicare coverage starts immediately after group insurance ends only to find out they have been left without health benefits because they didn’t complete the process on time!

If you are in your IEP and your birth month has already passed, this chart demonstrates that you must wait for coverage even if it means paying more.

If there is no other form of insurance available to cover the majority of medical costs before turning 65 years old, then enrolling during one’s 7-month Medicare eligibility window can be a wise decision.

However, failing to do so may result in an additional 10% Part B late enrollment penalty every full 12 months after missing out on these benefits due to age restrictions as outlined by CMS guidelines.

Wait for a Response From Medicare About Eligibility

The wait for a response from Medicare about eligibility is proving to be frustrating and tiring.

It’s been three months since I applied, but they still haven’t responded yet and the waiting game makes it difficult to plan things out like going back into school or even start working on my resume again just in case this doesn’t work.

If you’re eligible, make sure you understand what is covered by Medicare

For many people, Medicare is a life-saver. It’s important to know you’re eligible for the program and what services it covers so that you can plan accordingly.

How do I make sure my aging parents are able to afford healthcare? The best way is by understanding if they qualify for benefits like Medicare, which provides coverage in some situations when there may be gaps left open such as after retirement or disability has been determined.

If not, consider other options like Medicaid or private insurance

If you’re not sure of your coverage, consider these other options.

The cost to get insurance can be expensive and confusing. If it’s difficult for you to choose what type of plan is best for yourself or your family then there are alternatives that may offer better rates based on how much money the individual earns such as Medicaid or private health care plans with a high deductible but low monthly premiums

Understand that if you have any changes in income or medical conditions, it’s important to update your coverage with the Social Security Administration as soon as possible

Remember how you are in control of your coverage and have an obligation to keep the Social Security Administration up-to-date with any changes?

Changes in income, medical conditions, or other life events can drastically affect what kind (and amount) of benefits a retiree will receive.

That is why it’s important for everyone who collects their retirement benefit from social security to make sure they stay informed on all aspects related to receiving these funds – namely:

If there has been anything that might change eligibility requirements like when someone becomes eligible for Medicare; whether one needs new prescriptions because he/she may be taking different medications than before; etc., so as not to miss out on something crucial.

Conclusion

If you’re looking for help understanding Medicare, we can get you started. We have experts on hand to answer any questions and provide quotes in minutes so that you can be covered before the open enrollment deadline!