Are you New to Medicare Benefits

Medicare is a complicated topic. If you are new to Medicare benefits, don’t fret! We’ll walk you through the basics and give you some tips for navigating the system. Medicare coverage kicks in at 65 years old! However, there are exceptions for disabilities or injuries that occur before this age.

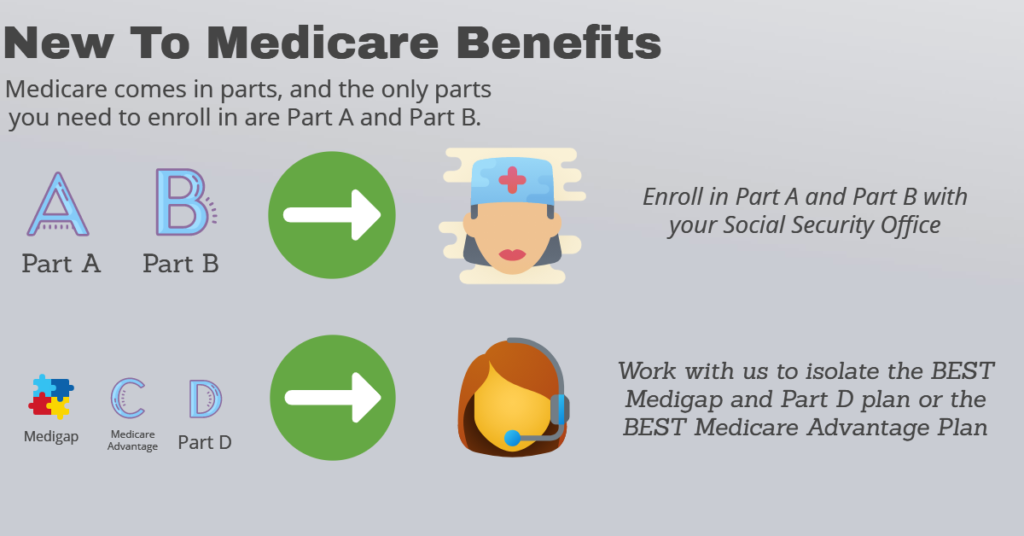

Plus, there are different types of Medicare coverage depending on your needs:

- Traditional Medicare and Part D Prescription Drug Coverage,

- Private Insurance Plans that supplement traditional Medicare (Medicaid), and

- Medigap Policies which cover things like copays or deductibles not covered by other plans.

We hope this article helps!

Article Navigation

So you’re new to Medicare?

What About If You Are New To Medicare As Your Primary Insurance

If you are new to Medicare as your primary insurance, then be sure to leave employer coverage behind before taking the next step. It can be overwhelming because it’s all new and different for you.

But never fear; transitioning from an old system is painless when we know how! You can find most of what you need about Medicare planning right here on this website – just search “new health care plan.”

You should know that Medicare is a federal health insurance program for seniors or those with disabilities. It’s comprised of different parts, each corresponding to specific benefits and services.

You can enroll in Original Medicare Parts A & B through the Social Security office but coverage will not be effective until you start receiving your monthly retirement check from them (which may take up to two months).

The other parts like Part C Medicare Advantage are done outside of this process either via an agent or agency and then mailed directly to you which ensures maximum convenience so no matter when it comes time for enrollment we have everything covered!

If you are already on Social Security, the government will automatically enroll in both parts of Medicare. Otherwise, a person must sign up for themselves manually.

If there is any chance that someone might have to be enrolled in Medicare as an adult and are not yet taking social security benefits (most likely because they’re still working), it’s important to know how this process works so that people can get started early if necessary.

Are You New To Medicare With Employer Insurance

There are many questions to ask when it comes time for retirement. Many people work well past the age of 65, so these decisions need to be made in order to best fit your needs and lifestyle. Do you want Medicare coverage as an addition or primary insurance?

Is employer-based health insurance worth having if you’re retired anyway since they often have lower deductibles than other plans do? Once those answers are answered, figure out what type of supplement is right for you; there’s a wide variety available!

The answer to whether you should stay on your employer’s plan or switch will depend greatly on the size of that company, and how much they charge for health insurance. You can find a rundown of all your options on our New Medicare with Employer Coverage page.

Common Questions about New To Medicare

New Medicare beneficiaries are constantly asking questions about their new coverage. Here’s a collection of some common queries:

Do I automatically get Medicare when I turn 65?

Medicare gives you the opportunity to enroll in Part B automatically by providing your Medicare card about 3 months before turning 65. If you are not getting disability benefits or Medicare after becoming a senior, it’s best that call Social Security at 1-800-772-1213 for assistance with registration and enrollment paperwork.

Does everyone have to enroll in Medicare at 65?

Medicare is a necessary coverage for retirees because it’s usually the primary form of health insurance. If you don’t enroll, then there can be consequences such as late penalties and delayed coverage; which could lead to other issues like not being able to receive Social Security benefits or even your retirement income.

How do I sign up for Medicare?

If you are aged 65 or older and have paid Medicare taxes for at least 10 years, then there’s a good chance that you will be eligible to receive premium-free Part A.

This is because the eligibility requirements also include having either received retirement benefits from Social Security or Railroad Retirement Board (which many of us do).

When should you start looking into Medicare?

Medicare is a social insurance program in the US. It provides health coverage for people 65 years and older, as well as some qualifying younger individuals with disabilities or permanent kidney damage who have worked enough to qualify for Social Security payments.

Medicare doesn’t cover everything so it’s important that you know about your options before enrolling at age 65 if possible!

PQ Medicare Solutions – We Can Help!!

Medicare can seem complicated, but let our no-hassle agents walk you through it step by step.

We start with teaching the basics so that you understand your Original Medicare coverage and then help choose a supplemental policy for yourself based on what works best for your needs.

Once we have set up an insurance plan, not only will you get peace of mind from knowing that we are there to answer any questions or concerns about how things work – but all services come at NO CHARGE!

Conclusion

If you are new to Medicare, or if you’ve been on it for a while but want more information about your benefits and how the program works, we can help.

We provide unbiased guidance so that no matter what type of coverage plan is best for you, our team will work with you through every step of analyzing which coverage options would be right for your needs. Get in touch with us today to schedule an appointment!