Compare Medicare Supplement Plans

It’s a jungle out there when it comes to Medicare Supplement Plans. With so many varieties, it can be hard to know which plan is best for your needs or budget. That’s where we come in! We’ll compare the plans and help you find one that will work for you and your family. In this article, we’ll explore what Medicare Supplement plans are, how they work with Original Medicare, and how to pick the right plan for you.

So if you’re looking for a comprehensive guide on comparing Medicare supplement plans then keep reading!

How to Compare Medicare Supplement Plans

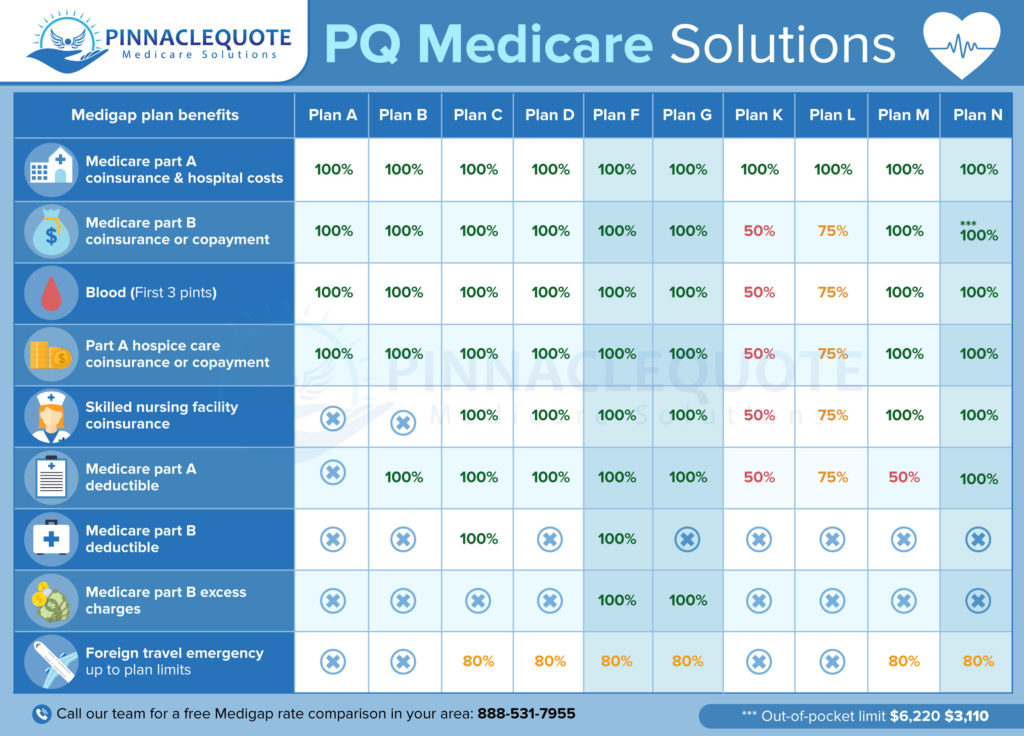

Medicare Supplements and Medigap plans are the same things, but each plan has a different letter (A-N). The Centers for Medicare and Medicaid Services updates their comparison chart every year to make comparing them easier.

Medigap plans vary in price and coverage. Some have higher premiums but offer more benefits, while others are cheaper because you agree to cover some of the gaps in Medicare yourself.

When comparing your options for Medigap insurance it’s important not only to look at how much they cost, but what type of coverage is offered by each plan as well!

Is Medigap the Same as Supplemental

If you are a senior citizen, Medigap plans can be the security blanket that will help to protect your hard-earned income from unforeseen medical expenses. What is more important than being financially prepared for an emergency?

Medigap coverage kicks in after Medicare pays its share of costs and covers things such as deductibles, copays, and coinsurance – it’s also known simply as “insurance”.

This type of supplemental insurance policy fills gaps left by Original Medicare (but not all) which means they’re both almost synonymous terms.

Which Medicare Supplement Plan is the Best

When comparing two of the most popular Medigap plans, Plan F and Plan G, you will notice that they have one difference: Part B deductible. The annual premiums for plan G are lower than those of Plans A through E.

If this makes your financial situation better–that is if it saves you more money out-of-pocket with regard to the Medicare deductibles as opposed to higher insurance payments annually–then enrolling in these lesser expensive options may be right up your alley!

Plan G has also gained popularity over Plan F due to the fact that those who become eligible for Medicare in 2020 or later are no longer able to enroll in Plan C and Plan F.

These plans cover a Part B deductible, so it’s understandable why there is now more interest directed towards Plans N which offer lower premiums if you’re willing to do some cost-sharing–though despite this reduction of costs, like with most other insurance carriers out there today, all these plans have their pros and cons depending on your situation. You may want to read up about them before making any final decisions!

How to Compare Prices for Medigap Plans, Benefits and Costs

In order to compare Medicare Supplement plans, you need a side-by-side comparison. The Medigap Comparison Chart allows you to see and compare all of the available options at one time so that it is easy for people like me who have no idea what they want in their plan.

A Medigap Plan F is the high-deductible option that means you will have to pay for your Medicare Coinsurance, Copays, and Deductibles up to $2,370 in 2021.

It’s always exciting to see what new things you can discover with Medigap Plans K and L. After meeting your annual out-of-pocket limit, the plan pays for all covered services until December 31st of that year!

Plan N pays 100% of the Part B coinsurance, with a copayment limited to $20 for office visits and up to $50 for ER visits that do not result in an inpatient admission. You can find this chart as well as other great info at Medicare’s Choosing a Medigap booklet available here.

Medigap Plan G also offers a high-deductible option. This plan has significantly lower monthly premiums, but it requires that you pay the first $2,370 of your healthcare costs before any coverage kicks in from Medicare.

Medigap or Medicare Supplement Plan Options Chart

The Medigap Plans comparison chart above will help you find the best Medicare Supplement plan for your needs. The plans are listed in order of profit, with Plan F and G being the most profitable options because they cover a high percentage of benefits leaving only 10% out-of-pocket while still providing no limit on coverage.

If you’re interested to know more about one or multiple specific plans below is our detailed overview:

Plan A

Medigap Plan A is one of the most essential Medigap plans because it covers for 20% that Medicare does not pay. If you live in a state where people under 65 on disability are required to have an insurance plan, then this could be your best option!

Plan B

Medigap Plan B pays your Medicare Part A hospital deductible and all of the care that is covered by Medigap Plan A. Take a look at any other plan to see if it can provide you with more comprehensive coverage for less money, but make sure you read up on what each one covers before signing anything.

Plan C

Medigap Plan C is a supplement that provides coverage for everything except Medicare excess charges. This means it pays both of your deductibles and the 20% you would normally owe toward all outpatient expenses. Medigap plans C & F are very popular with seniors who want to make sure they have maximum protection from high costs associated with healthcare as well as lower out-of-pocket health care expenditures in general, which helps them plan better financially now and into retirement.

Plan D

If you want to save money on out-of-pocket costs and are willing to make some sacrifices in the scope of coverage, then Plan D is a good option for many people. It covers most things but does not cover Medicare’s deductible nor any excess charges like hospitalization or skilled nursing care which can really add up when they happen during your stay at home instead of being covered by insurance. This makes it one of the least popular Medigap plans so don’t confuse it with Part D, which is drug coverage – two different things!

Plan F

When it comes to Medigap Plans, Plan F is a top seller. It covers all of your expenses and leaves you with nothing out-of-pocket for covered services. If you don’t want anything coming up on your statement but still need coverage, this plan gives great peace of mind knowing that doctor visits or hospital stays won’t cost more than an office visit thanks to no copays!

Plan G

In recent years, Plan G has been gaining in popularity as an alternative to Plan F. Not only does it cover everything that Plan F covers but also the Part B deductible which is often a less expensive and more convenient way for seniors who have Medicare A&B coverage to supplement their healthcare needs. When we compare plans with similar benefits, premiums are usually lower on average than they would be if you were just purchasing plan I without any supplements at all.

Plans K, L, & M

As the name implies, Medicare Supplement plans are supplemental to what you would receive through your original medicare coverage. These Plans K and L offer partial benefits for certain medical treatments such as Plan K covering 50% of most items while Plan L offers 75%. However, these types of plans are rarely requested by people on Medicare so not all insurance providers provide them. If they do happen to be available in your area however then it’s possible that a good rate could be found depending on which one is right for you!

Plan N

Medigap Plan N is a plan that provides lower premiums in exchange for beneficiaries to pay copays on certain things like doctor and emergency room visits. It also does not cover the Medicare excess charges, which can be an annoyance to some people as they find small bills from these fines annoying.

Do all Doctors Accept Medicare Supplement Plans

Medigap plans are not limited to one network of doctors. Hundreds and thousands of providers across the United States will be available for your use as long as they accept Medicare, which is why Medigap coverage should always be a priority in any retirement plan.

With Medicare, you are not limited to a network of doctors. If your doctor participates in the program, then they will accept reimbursement from Original Medicare plans as long as it is still an active practitioner and health care provider. This means that around 93% of all US primary care physicians participate in this plan!

Medicare Supplement Plan Types

When it comes to your Medicare Supplement plan, you have three options:

- community-rated,

- issue age rated or

- attained age rated.

If the area in which you live offers a low cost for one of these plans then that is likely what would provide the most savings on healthcare costs due primarily to inflation rates and how much they can change annually depending on where someone lives.

Medigap Plans Rate Comparison

When comparing Medicare Supplement insurance prices, keep in mind that they are standardized. The same plans offer the same benefits no matter where you buy them from- making it simple to find deals on rates between policies.

When you’re looking for a new carrier, it’s important to find the company that best suits your needs. That means evaluating things like price and coverage areas as well as rating information.

We always look at all of these factors when we make recommendations because our goal is to provide clients with options that are right for them!

We can give you an accurate and customized comparison of Medigap plans in your zip code. This will help you compare current rates AND rate increases over the last few years to make sure that a carrier has stable long-term rates for your needs.

Fill out the form on the right of this page for more information about how our Medicare Supplemental insurance cost comparison software works, or if already know which plan is best suited for what type of coverage do not hesitate to contact us!

Shop Rates With Us and Recieve Your Own Customized Report

PQ Medicare Solutions is an easy way to find the best Medigap plans for your needs. With our free rate comparison report, you can quickly and easily compare rates so that you know which plan will suit your budget. We also provide educational resources on Medicare so new seniors can be confident in their next step!

If you want to know what Medicare covers, it’s easy with the help of our friendly customer service team. Just call us at (855) 380-3300 and we will be happy to answer any questions that you may have!

Conclusion

If you’re looking for a new Medicare plan, don’t settle on just one. Compare the plans below and see which suits your needs best! Be sure to get in touch with our team of experts if you have any questions about what might be right for you- we’ll happily answer them all so that you can make an informed decision when it comes time to buy coverage.