Medicare Supplement Plan F: Everything you need to know

✅ To Find Out Which Medicare Supplement Is Best For You Fill Out The Form 👉

Table of contents

MEDICARE SUPPLEMENT

Medicare Supplement (Medigap) are insurance plans that fill in gaps that Original Medicare doesn’t. In other words, Medicare Supplement begins where Original Medicare ends, it doesn’t necessarily replace Original Medicare, rather it supplements for it, providing additional coverage for missing benefits.

Medicare Supplement basically covers the cost of healthcare services not covered up for by Medicare Part A and Part B insurance plans, extending its reach beyond the limits of Original Medicare, including Copayments, coinsurances and deductibles. Medigap beneficiaries pay monthly premiums for Medigap policies directly to the Insurance providers. Medicare Supplement policies do not replace Original Medicare, rather as the name implies, they merely supplement for it.

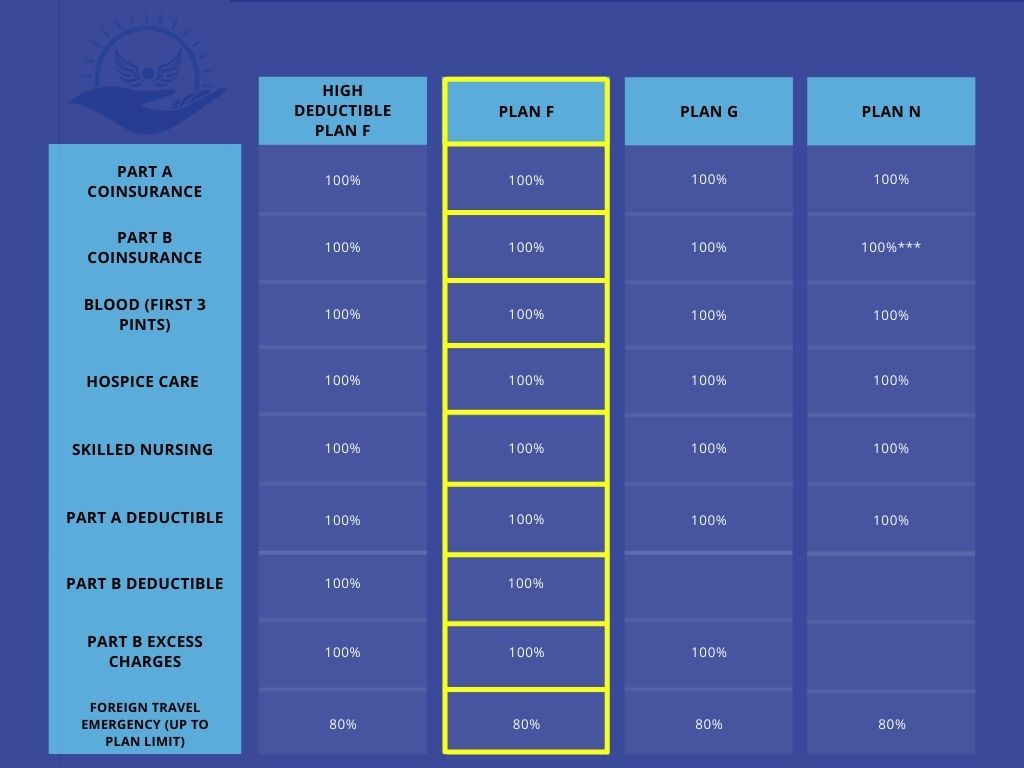

There are 10 Medicare Supplement plans functioning across 47 states that are standardized with lettered names A – N. Some of these plans will be analysed to give you an insight into how they function and operate.

WHAT IS MEDICARE PLAN F?

Medicare plan F is one of the most standardized Medicare Supplement plans that provides 100% coverage for services not covered for by Part A and Part B Medicare. It is a really comprehensive plan, providing extensive coverage for individuals who require broader assistance with out-of-pocket costs in Original Medicare.

In most states, Medicare Plan F is Standardised, just like other Medigap policies and as a result, beneficiaries will receive the exact benefits for any Plan F policy they purchase, wherever they are.

WHAT BENEFITS CAN I GET FROM MEDICARE SUPPLEMENT PLAN F?

Plan F offers the following benefits:

- Inpatient hospital costs and coinsurance under Medicare Part A for an additional 365 days after Medicare coverage runs out.

- Coinsurance for skilled nursing care facilities

- Medicare Part A & B deductibles

- Medicare Part B coinsurance/copayments

- First 3 pints of blood

- Hospice care coinsurance/copayments under Part A

- Excess Charges

Plan F covers up to 80% for foreign travel emergencies as well.

Despite offering such comprehensive coverage, Medicare Supplement Plan F doesn’t cover every cost you may have in Original Medicare. You still have to pay your Part B premium. If you haven’t worked enough quarters (at least 40) you’ll owe a premium for Part A. Plan F doesn’t provide coverage for such out-of-pocket costs.

HOW MUCH DOES MEDICARE PLAN F COST?

The cost of a Medicare Supplement Plan F depends on your location, personal health and the insurance companies in your area. The plan cost ranges from $120 to $140 per month for seniors. You’ll see the same benefits at varying costs by different insurance companies. Be sure to compare rates across different insurance companies.

Federal government forbids private insurers from selling Medigap policies to Medicare Advantage members. You can’t have both a Plan F and a Medicare Advantage Plan.

Carriers can price their Premiums in one of three ways:

- COMMUNITY RATED: Premium costs are not based on age.

- ISSUE-AGE RATED: Determined by how old you are when you buy the policy. Premiums are lower for younger buyers and higher for older buyers, but then remains static as you age.

- AGE-RATED: The premium increases as you age. In this case, your policy will become more expensive as you grow older.

PLAN F DEDUCTIBLES

Plan F offers high deductible and standard deductible options depending on your location. You”ll have lower premiums for this plan, you’ll pay a deductible before plan F starts paying. You pay out-of-pocket up to the deductible amount of $2,370 before your policy starts paying. There is also a separate deductible of $250 for medical expenses when you make a foreign trip.

The high deductible option may be just right for individuals who don’t mind paying for out-of-pocket costs up front. More so, it could be useful for healthy individuals who may not need frequent medical services.

The high deductible Plan F is the same as the standard Plan F when it comes to basic benefits. If you decide to back to the standard plan, you’ll have to undergo medical underwriting.

Please bear in mind that with effect from 1st of January 2020, Medigap plan F will be phased out. If you didn’t qualify for Medicare before December 31st 2019, you wont be able to purchase Plan F. This policy change applies to Medicare supplement insurance plans that cover Medicare Part B annual deductible (Plan C and Plan F). however, if you qualify for Medicare before 1st of January 2020, you may still be able to purchase Plan F, but if you already have Plan F your plan still remains.

GUARANTEE ISSUE RIGHTS & PLAN F RATE INCREASES

If you’ve got a Plan F, more than likely you’re familiar with rate increases. This is because most Medicare Supplement companies are giving renewal increases across board. The increase in rate applies to all Medicare Supplement plans and not just plan F.

If you are on Medicare, likely you have a Medigap plan to cover your deductibles, copayments and coinsurance. After years of being enrolled in a Madigap plan, you must have become familiar with dreaded rate increases. Letters keep dropping, notifying you of increase in rates periodically.

You must be wondering the reason for these rate increases? The reason is, the more claims a company has to pay, the higher your premiums will become. Different companies get different claims, so the rates may differ from one insurer to the other.

It is quite difficult to completely avoid rate increases, so we recommend that you re-evaluate your Medicare Supplement plan every year. Once its your policy’s anniversary date, it is advisable to re-evaluate your plan by contacting an agent that will help you run some quote comparisons. You will try to find out if they are other companies that run the same plan for lesser cost.

Guaranteed Issue (GI) events are times you can sign up for a plan without having to pass medical underwriting.

However, when you have a Guaranteed Issue rights, the insurance company must sell a Medicare Supplement plan sold in your state to you without recourse to your health history. The insurance company must also cover your pre-existing conditions. If you have a serious health condition, the company cannot increase your premium, they must sell you the plan at the same premium they charge others.

Most companies will take you through the medical underwriting process and ensure you pass before offering you a plan. During Medical underwriting, the insurer may go through your past medical history and records and if that find out that you have any serious or chronic condition like diabetes or heart disease, they may decline from issuing you a policy. Also, depending on your health history, they may decide to sell you another plan with less comprehensive coverage or impose a waiting period on pre-existing conditions.

These GI events happen if you get dropped from your group plan. So if your employer coverage ends, you should keep the creditable coverage letter from your prior insurance carrier. In such circumstances, you have a 63-day window to choose a plan.

Also, when you turn 65 or you’re signing up for Part B for the first time, there’s a federal regulation that exists which allows anyone, irrespective of your health status to be accepted for a Medicare Supplement plan. This special situation is called “Open enrollment” which gives you the leverage to purchase any plan without needing to pass any medical underwriting for 6 months.

PLAN F vs. PLAN G

Medigap policies F and G share quite a number of similarities in terms of benefits but there is one key difference that sets them apart and makes one distinct from the other. Plan F offers the most coverage out of all Medigap (including Plan G) plans and covers Medicare Part B deductible as well but Plan G does not. With such extensive coverage, Plan F often comes with higher premium and a high deductible option if you decide to get more coverage.

Despite the above differences, Plan F and Plan G offer quite a number of similar benefits which includes:

- Part A coinsurance and hospital costs.

- Part B coinsurance or copayment

- First 3 pints of Blood

- Skilled Nursing facility care coinsurance

- Part A hospice care coinsurance or copayment

- Part A deductible

- Excess charges

- Up to 80 percent medical emergency costs during foreign travel

- 0 out-of-pocket limit

Cost vs. Benefits

While Plan F premiums are a little overboard in terms of cost, Plan G offers lower premiums for a little bit of cost sharing at your own end. Given the rising cost of healthcare across the country, there has been a paradigm shift in health care insurance policies, particular towards consumer-driven plans.

Individuals and corporate bodies tend to have more interest in plans that give them lower premiums if they do a bit of cost-sharing. Though plan G does not cover the part B deductible which was $198 in 2020, the premium savings cost could offset the cost of the yearly deductible.

In 2020, the average premium costs around $16 to $210 for Plan F and $185 to $250 for Plan G, for a 65-year-old who does not use tobacco. On average, Plan G costs around $25 to $40 per month which sums up to an annual savings of $300 to $380 per year and that well pays for the annual Part B deductible.

Basically, Medigap premiums depend on such factors like; a person’s age, gender, marital status, area of residence and whether they smoke or not. Individuals who choose the standard Plan G pay a monthly premium that varies among states. Premiums may, however vary depending on if a person chooses a standard or high deductible policy, regardless if its Plan F or Plan G.