Medicare HMO vs PPO: Which is best for me?

✅ To Find Out Which Medicare Plan Is Best For You Fill Out The Form 👉

Table of contents

That’s a GREAT question!

Medicare HMO vs Medicare PPO, for YOUR specific needs. In this article you’ll learn exactly what the advantages and disadvantages of both are, and how you can confidently make your choice and focus on the important things in life…

To make this easy, let’s start with the one question that’s on everyone’s mind…

What Do All These Letters Mean?!

That parts easy

- HMO = Health Maintenance Organization

- PPO = Preferred Provider Organization

What’s important is what do those titles mean to YOU and how YOU receive your healthcare.

What is an HMO & What Does it Cover ?

A Health Maintenance Organisation, or HMO, is a network of healthcare providers brought together by the insurance company to provide a coordinated care to its Members.

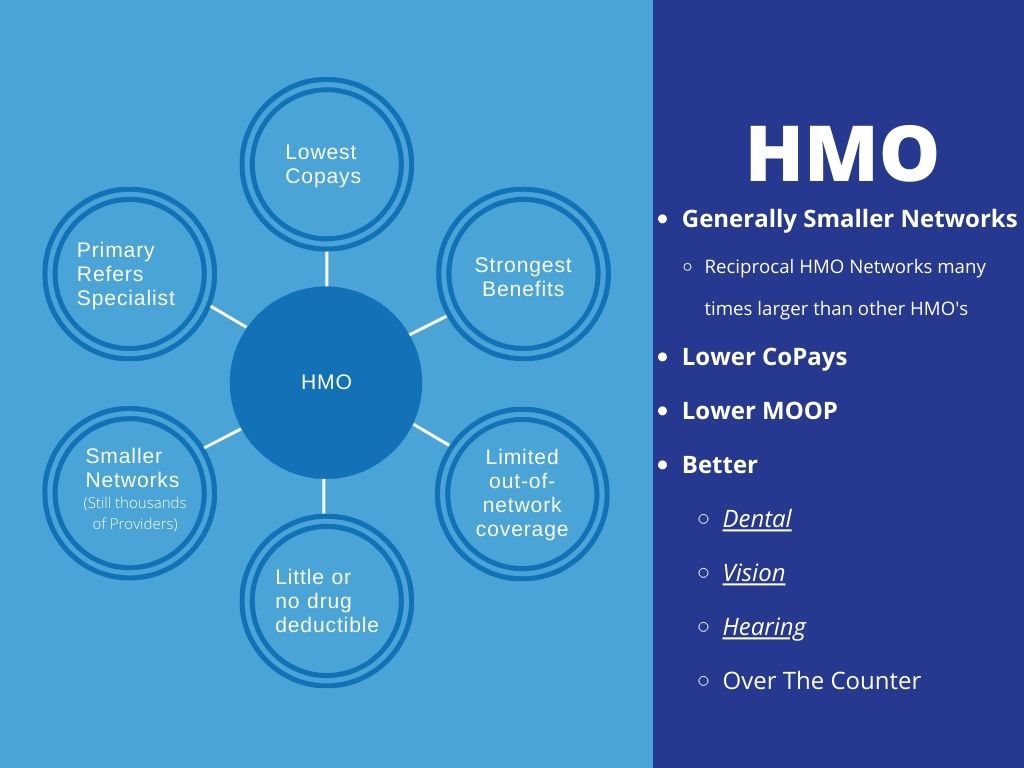

HMO’s typically have much lower out of pocket costs, and a lot more benefits than a PPO plan does.

The Max Out of Pocket (MOOP) is the maximum amount of money you would have to spend in a calendar year before the insurance company would pick up the rest of the bill completely.

Typically HMO’s have lower (sometimes less than half) Max Out of Pocket cost than PPO’s.

HMO’s tend to give you more Copays than Coinsurances. This means simple flat rate Copays instead of 20-50% coinsurances. Best of all the Copays themselves are also going to be lower on most HMO plans than they would be on a PPO plan in the same area.

In other words…

In and HMO Network, you’re going to spend significantly less out of pocket than you would in a PPO Network.

There’s always a trade off…

Smaller networks are one of the first that come to mind. Many HMO plans are forming Reciprocal Networks to give HMO Beneficiaries a wider range of options.

Your PCP will be the gatekeeper when you’re in need of a new specialist. It’s so important to make sure you have a PCP that you Know, Like, and Trust. If you have that, then this can go very smoothly.

It Works Like This…

- You have some ache, pain, or discomfort that isn’t normally there

- You schedule an appointment with your PCP

- Decision Made! You Need a Specialist…

Not just by your PCP, you can still ask to see one and a good one will give you the referral (remember Know, Like, and Trust)

- Your PCP gives you a referral and your next appointment is to see the specialist

Since HMO’s have you seeing your PCP so much, the Copay to see your PCP $0 on most plans

What is a PPO & What Does it Cover?

A Preferred Provider Organization, or PPO, is also a network of healthcare providers, brought together by an insurance company to serve their Members.

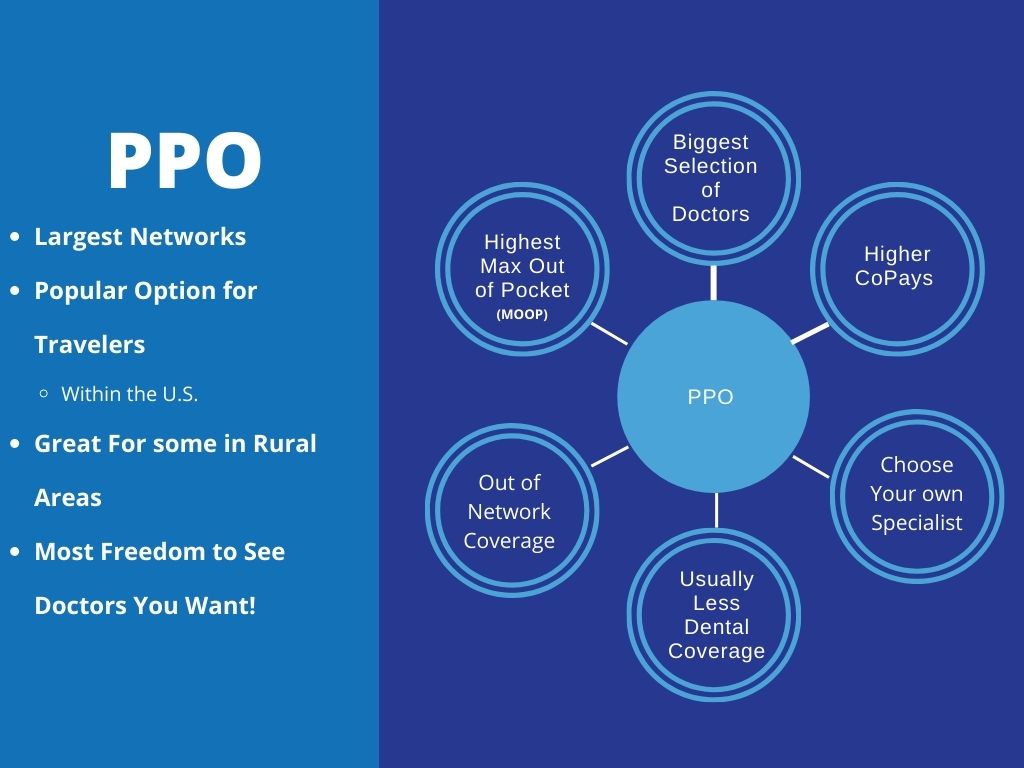

Different than an HMO, a PPO doesn’t designate a Care Coordinator. Instead, they give you a much larger selection of Doctors, Health Care Providers, and Hospitals (both in network and out) to choose who you’d like to receive your care from.

You still want to designate a Primary Care Provider (PCP). They may not be your Care Coordinator, but your Copay is less to see your PCP than it is to see a Specialist.

PPO’s are great plans for those that live in multiple locations throughout the year, or go on extended stays with family.

- Even if your family lives out of state, your PPO plan may still have in network doctors wherever you’re staying

- If there aren’t any, your PPO plan still offers you out of network coverage. As long as you’re in the US, you’ll have coverage as laid out in your plan.

But like I said…

The biggest trade off a PPO makes to offer all this freedom is more cost to you when you use your plan

- Higher PCP and Specialist Copays than with an HMO

- Typically more Coinsurances than an HMO

- i.e. instead of a flat $30 copay, you’ll pay 20-50% for many services

- Sometimes times as much Max Out of Pocket (MOOP) as an HMO in the area

- Weaker Dental, Vision, Hearing, and Over-The-Counter benefits packages as an HMO

Also, be very sure of what your out-of-network rates are. These are significantly higher than the in-network-rates.

Who Should Have and HMO? Who Should Have a PPO?

This is a case by case answer that you should come to with your agents guidance. The winner of Medicare HMO vs Medicare PPO is going to be different for every client. There are a lot of factors to consider. The first one being: “What’s available in my area?”.

You may LOVE the idea of an HMO, but if there are no HMO’s in your area that cover all of your needs then you’re going to be better off on a PPO plan.

With that being said, here are some examples of why you might choose one over the other:

PPO

- You’re Snow Birds!

- Yes, if you live in different states throughout the year, 9/10 you are going to want a PPO plan

- You’re Country!

- If you live in rural area, and have to travel far to see our doctors, there may not be HMO plans in your area with strong enough networks to serve you.

- You Control Your Destiny!

- Often our clients with great HMO options in their area, still opt for the higher cost of a PPO simply to have more options and/or be able to choose which Specialists they see and when. (And there’s absolutely nothing wrong with that. )

HMO

- You Like Your Team of Doctors Already!

- In most areas, HMO networks are large enough that they accept all the doctors our clients are already seeing. So for them, it’s a no brainer to pay less out of pocket for the same service they would otherwise be getting.

- You’re a City Slicker!

- Major cities have the lowest cost HMO plans available. And since you live in a high population area, you naturally have a lot more doctors near by you. Chances are there’s an HMO in your area that covers whatever combination of Doctors and Healthcare Providers you can throw at it.

- You Like to Leave it to The Pros!

- Many people like their Primary Care Provider coordinating their care. They take comfort in a tight network of professionals at their disposal to keep them in good health during retirement.

Should I Choose a Medicare HMO or PPO?

When we’re helping our clients choose a Medicare Advantage Plan, we follow this simple step-by-step process:

- Find All of The Plans in Your Area

- Exclude Any That Don’t Cover Your Providers and Your Medications

- Determine If You Need In-Network Options in Other States

- Decide How Much Dental, Vision, Hearing, and OTC Benefits you want

- Of The Plans Left, Choose The One That Cost You The Least Out of Pocket Throughout The Year

Pitfalls To Avoid

In the Medicare HMO vs Medicare PPO debate, you’ll hear a lot of very hard and fast answers. But if those answers aren’t based off of a detailed analysis of your unique needs, then they don’t mean much…

- Choosing A Plan Just Because Your Friend or Relative Has it

- Choosing A Plan Based on Dental, Vision, Hearing, or OTC Benefits only

- Avoiding Certain Carriers Because Your Out of Town Relatives Didn’t Like Them (these plans vary wildly from county to county)

- Working With an Agent Who Doesn’t Call You Yearly to Go Over Any Plan Changes, or Changes to Your Needs

Conclusion

That step-by-step process we outlined earlier is exactly the kind of care we give to every one of our clients. Fill out the form on the right side of this page and schedule some time with one of us to ask all of those important questions. Once we have only a handful of options left that are going to cover YOUR needs, then we can have the Medicare HMO vs PPO talk and choose the one that’s best for you!